Understanding and implementing a multi-income approach can empower you to shape your financial destiny.

In recent years, the cost of living in most economies has drastically increased due to inflation, wage stagnation, high interest rates, and record job losses. This makes it impossible for a single source of income to keep up with the quality of life and standard of living. But, diversifying your income can create a safety net that provides a sense of security and confidence.

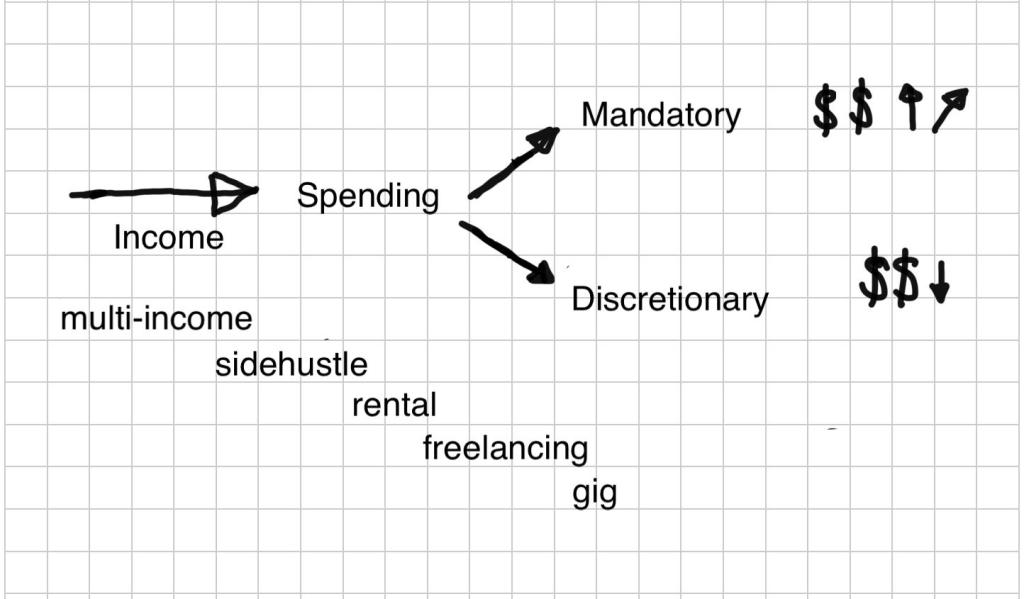

Income is the cornerstone of personal finances. Without steady earnings, there can be no savings, protection, investing, or spending on essentials and non-essentials. To achieve our financial goals and ensure our financial stability, we must actively seek multiple sources of income and manage our spending. These sources include wages, salaries, rental properties, interest from savings, pensions, dividends, business ownership, and other investments.

A multi-income strategy combines various income sources to build a robust financial portfolio. For instance, you can use your employment income, like wages or salaries, to invest in dividends, stocks, or rental properties. Additionally, you can supplement your primary income with a side hustle or gig job, like a second job, selling online, freelancing, or providing delivery services to generate more revenue.

It is easy to get entangled between increasing income and spending, especially discretionary spending like vacations, clothing, electronic gadgets, dining out, entertainment, and other expenses. It is crucial to keep track of all your income and spending to make sure money is allocated to the relevant portfolio, which includes savings, investments, and lifestyle habits. Furthermore, an increase in employment income can be directed to savings or investments, not spending more. If possible, spending should be kept to the least by changing your lifestyle to suit your financial situation. Spending should slowly increase as income increases, starting with essentials and discretionary expenses later. Mandatory expenditures include food, utilities, transportation, insurance, health expenses, rent or mortgage, taxes and childcare.

The idea is to make sure that spending does not surpass your income.

Sources

CFI Team. (2024). Personal Finance. Corporate Finance Institute. https://corporatefinanceinstitute.com/resources/wealth-management/personal-finance/

FNCB Bank. (n.d.). Why Is Personal Finance Important? http://Www.fncb.com. https://www.fncb.com/Why-is-Personal-Finance-Important

Munohsamy, T. (2015). (PDF) Personal Financial Management. ResearchGate.

https://www.researchgate.net/publication/279198054_Personal_Financial_Management

TD Bank. (2024). Everyday Finances: Financial & Investment Planning | TD Canada Trust. Tdcanadatrust.com. https://www.tdcanadatrust.com/planning/everyday-finances-made-easy/everyday-finances-made-easy/discretionary-spending.jsp