The impact of tariffs is a subject of ongoing debate. While some argue that tariffs protect domestic industries and generate government revenue by taxing foreign goods, others contend that they harm the economies of both the imposing and targeted countries, ultimately increasing consumer costs. This post will focus on the impact of tariffs on stock market investors during current global trade disputes, particularly those involving the U.S., Mexico, China, the EU, and Canada, and explore strategies for navigating these turbulent markets successfully.

The ongoing debate over U.S. tariffs on Canada, Mexico, China, and the EU has generated significant economic uncertainty, particularly affecting North American equity markets through increased volatility and investor apprehension.

What are tariffs and its Purposes

A tariff is a tax imposed by a government on goods imported from other countries. Tariffs are primarily of two types: taxes on goods brought from another country, known as import tariffs, and taxes on goods sent to another country, known as export tariffs.

Tariffs mainly serve two purposes: to protect locally produced goods against imported goods in order to foster domestic producers and grow local jobs, and to generate revenue for the government.

On the other hand, economists are wary about the use of tariffs to reduce a country’s deficit because they may increase the cost of goods for consumers but encourage more exports of goods instead to solve the problem. Also, tariffs may lead to a trade war, inflation, and higher costs that are passed down to consumers.

Why the Recent U.S Tariffs Policies?

In the past, tariffs have been used by political leaders to boost domestic manufacturing in order to create jobs. Similarly, President Trump’s administration employed the same tactics to protect local industries by balancing the trade deficit, generating revenue, and growing the United States of America workforce, which he campaigned on these promises during his campaign.

Investing Road Map Insights

As seen above, tariffs on goods imported into the United States of America can be viewed differently, with one side for and the other against, which creates significant economic uncertainty globally. If there is one thing the stock market and business in general despise, it is any form of uncertainty and unpredictability, which causes businesses to not invest or expand, meaning less economic growth and leading to a period of volatility in the market.

Recent Historic Events That Crash the Stock Market

Historically, the stock market has weathered numerous uncertainties and has proven time and time again to triumph over any obstacles the world has experienced. In my less than a decade of investment experience, I have witnessed some of the market’s worst periods, such as the COVID-19 pandemic. Despite this, the stock market has not only regained all its losses but has also reached new highs. Other examples of uncertainties caused by recent events include:

- Dot-com Bubble Collapse in 2000 – 2002

- Financial Crisis 2008

- Coronavirus Pandemic 2020

- Trump Reciprocal Tariffs 2025

- What’s next?

In the moment, witnessing losses in the market can be unsettling, though this often becomes clearer in hindsight when observing the overall market trend. I am optimistic about the potential for stocks to rise despite the current tariff uncertainty, as history has demonstrated the stock market’s resilience in rebounding from various uncertainties. However, this recovery may be accompanied by volatility and a period of time constraint, as many investors have cautioned.

History Shows Market Will Rebound after Recent Sell-off

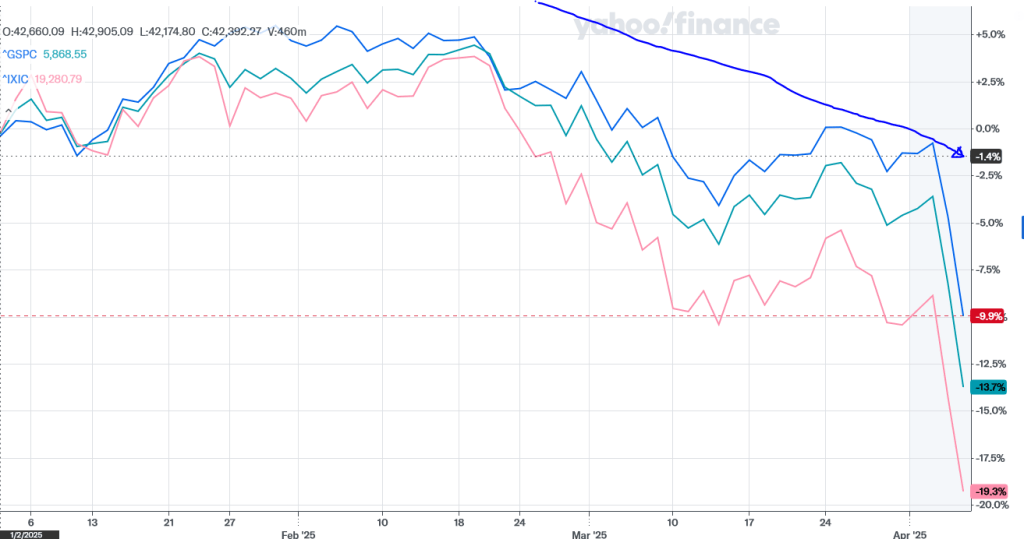

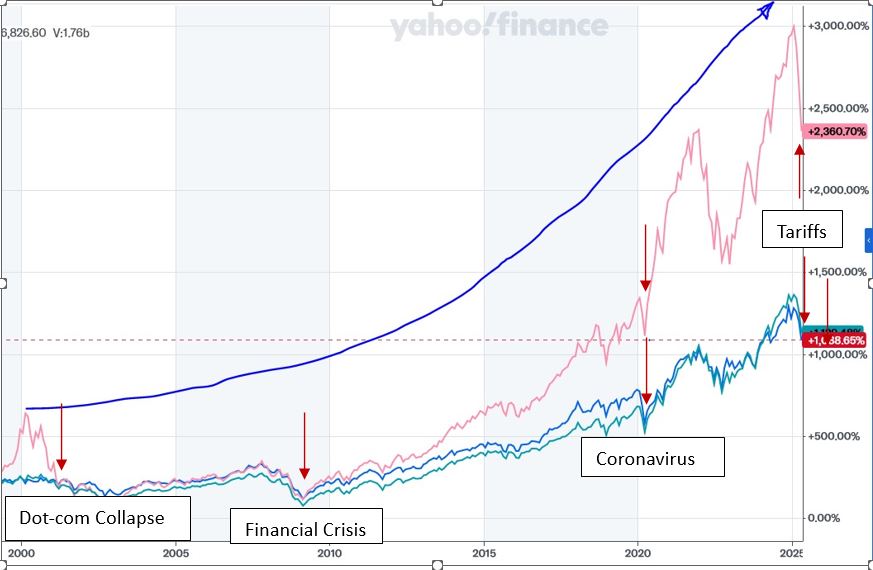

Below is a chart illustrating the year-to-date (YTD) market reaction of major indices to potential tariffs from the White House and potential trade retaliation from other countries, compared to other historic events from years past. Examining the YTD chart reveals a downward trend, with the major indices plummeting and nearly erasing a year’s worth of gains. Conversely, the second chart, from the 2000s, demonstrates long-term recovery, with indices bouncing off their lows, recovering sharply, and reaching new highs. My key takeaway is simple: stay invested.

Chart of Major Indices YTD

Chart of Major Indices from 2000s – Present

My Current Investing Strategies

My investing strategies remain consistent. I am simply adding to my positions in quality stocks with strong fundamentals to learn more see my preious post for more details on Top Stock Picks for 2025: A Comprehensive Review At this point, I will be deploying funds that I do not anticipate needing in the short term. This is because it is clear that the duration of the current selling pressure is uncertain, hence the prevailing market uncertainty and volatility.

Sources

Joy, D. S. (2024). Tariffs: What are they, who pays for them and who benefits? News and Events. https://dornsife.usc.edu/news/stories/tariffs-explained-by-economics-professor-trade-expert/

Letzing, J. (2025). How do tariffs work – and do they work? World Economic Forum. https://www.weforum.org/stories/2025/02/how-do-trade-tariffs-work/

Macklem , T. (2025). Tariffs and trade uncertainty are hurting the Canadian economy. Bankofcanada.ca. https://www.bankofcanada.ca/2025/03/tariffs-and-trade-uncertainty-hurting-canadian-economy/

Williams, W. (2022). Timeline of US Stock Market Crashes. Investopedia. https://www.investopedia.com/timeline-of-stock-market-crashes-5217820

Yueh, L. (2018). A Quick Review of 250 Years of Economic Theory About Tariffs. Harvard Business Review. https://hbr.org/2018/07/a-quick-review-of-250-years-of-economic-theory-about-tariffs