The US News report ranks Canada in 2023 as one of the top three countries in the world for quality of life. Additionally, the City of Toronto is ranked globally as the 92nd most expensive city to live in, according to Mercer’s 2024 Global City Cost of Living report.

This analysis is tailored for newcomers, immigrants looking to move to Canada, or Canadian workers interested in learning more about their finances. In 2022, the average after-tax income for Canadians varied depending on their geographic region, province, or territory, with a national average of $57,000.

Tax Deduction

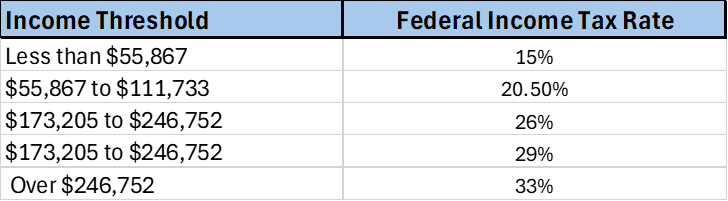

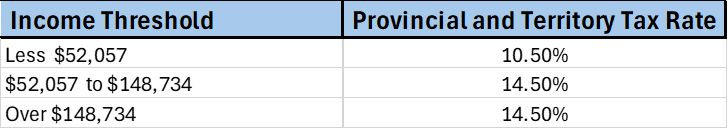

In Canada, taxes are applied at various levels, including federal, territorial, and provincial taxes, and taxes on purchases of goods and services. Additionally, individuals’ taxable income thresholds vary depending on their annual earnings.

As shown in Figure 1, the idea is that the more money you make, the more you pay in taxes. For example, if your annual salary is $55,867 and you live in Saskatchewan, the federal and provincial/territorial tax rates are 15% and 10.50%, respectively; and taxes on purchases and bills. After both taxes are deducted, the amount that remains in your bank account is $40,601.34.

Cost of Living

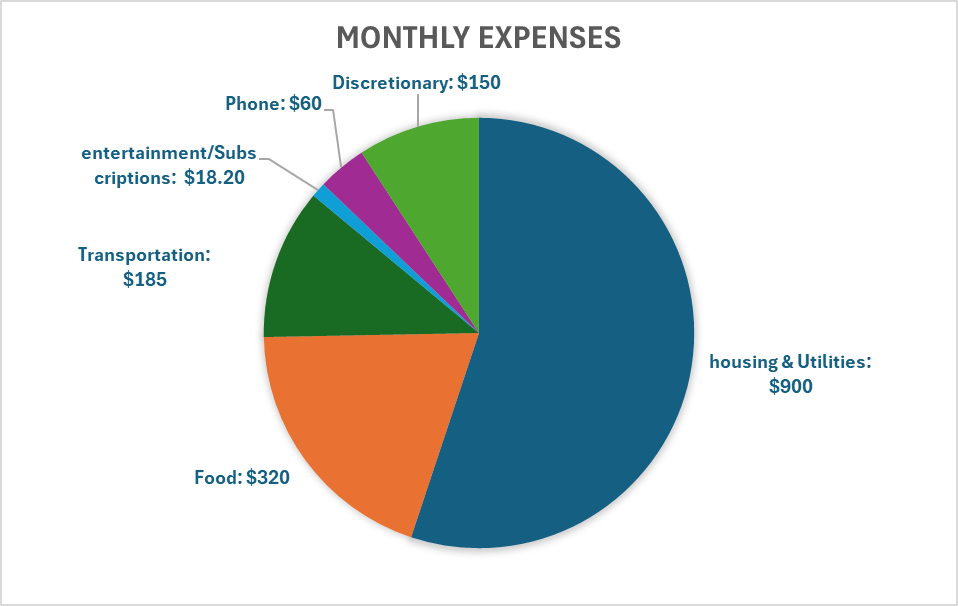

The cost of living has drastically increased in recent times, especially post-pandemic. To simplify, we used $40,601.34 received in your bank account and divided it by the number of months in a year, which resulted in $3,383.45 per month. The cost of living depends on individual lifestyle, so in this case, we use hypothetical data including housing, food, transportation, healthcare, entertainment, and utilities. Additionally, for families with both spouses working, there can be significant tax advantages, and the cost of living is often lighter with two incomes compared to a single income.

The total monthly expenses of $1,633.20 can vary depending on the individual and their geographical location, which makes expenses higher or lower.

Remaining Monthly Pay: $3,383.45 – $1,633.20 = $1750.25

In reality for newcomers, the remaining funds can be far less due to the first expenses of acquiring everything needed to get settled.

The analysis indicates fewer funds left over than expected when comparing the total annual salary before taxes to the amount remaining after each monthly paycheck. Building a strong personal finance needs setting aside more funds from paychecks for emergency savings, investments, retirement accounts, or significant purchases like buying a home or going on a well-deserved vacation.

Sources

Canada Revenue Agency. (2024). Canadian Income Tax Rates for Individuals – Current and Previous Years – Canada.ca. Canada.ca. https://www.canada.ca/en/revenue-agency/services/tax/individuals/frequently-asked-questions-individuals/canadian-income-tax-rates-individuals-current-previous-years.html

Mercer. (2024). Cost of living. Www.mercer.com. https://www.mercer.com/en-ca/insights/total-rewards/talent-mobility-insights/cost-of-living/

Statistics Canada. (2020). Income of individuals by age group, sex and income source, Canada, provinces and selected census metropolitan areas. Statcan.gc.ca. https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1110023901

US News. (2020). Canada Ranks Among the World’s Best Countries. Usnews.com. https://www.usnews.com/news/best-countries/canada

Good one

LikeLiked by 1 person

Thank you.

LikeLike